As professionals in the ever-evolving landscape of the financial services industry, your primary goal is to provide clients with investment solutions that align with their unique needs and aspirations. This is where the concept of investment suitability takes center stage – a compass that navigates the complex waters of cross-border factors, country-specific regulations, and diverse client profiles. In this blog post, we’ll explore the essence of investment suitability and provide you with comprehensive guidelines for achieving investment suitability to ensure your clients’ financial success.

Understanding investment suitability

Investment suitability is the cornerstone of responsible financial advisory. It involves an in-depth evaluation of your clients’ financial goals, risk tolerance, investment preferences, time horizon, and existing financial situation. By meticulously considering these factors, you can craft an investment strategy and investment recommendations that are tailor-made for each client, steering them towards their financial objectives with confidence.

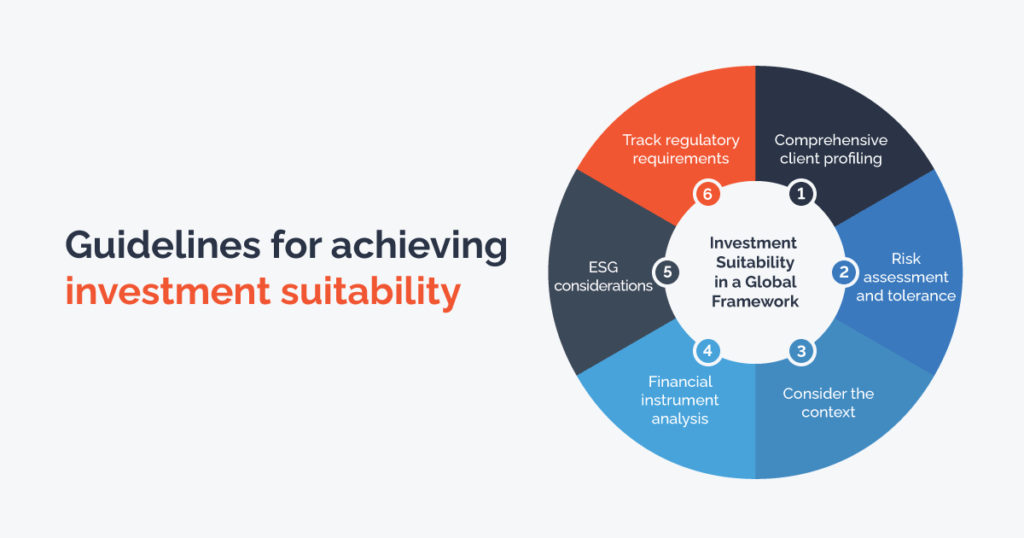

Guidelines for achieving investment suitability

- Comprehensive client profiling: Begin by thoroughly understanding your clients’ financial background, including income, expenses, debts, and long-term goals. This profiling lays the foundation for suitable investment recommendations.

- Risk assessment and tolerance: Gauge your clients’ risk appetite through thoughtful discussions and risk assessment questionnaires. Balancing risk and return is key to ensuring a suitable investment strategy that aligns with their comfort levels.

- Consider the context: Take into account the geographical location and communication channels used during interactions with your clients. Consider whether these interactions occur in a specific country or region and whether they take place through in-person meetings, virtual communication, or other channels. Also, factor in your clients’ knowledge and experience with investing, as well as any foreseeable life changes that could impact their investment choices.

- Financial instrument analysis: Evaluate the characteristics and complexities of various financial instruments to ensure they are suitable for your clients’ investment profile and objectives.

- ESG considerations: Understand your clients’ preferences and beliefs regarding environmental, social, and governance (ESG) factors. Incorporate ESG considerations into investment decisions for clients who prioritize sustainable investing.

- Stay informed about cross-border regulatory nuances: In the realm of investment suitability, regulatory requirements can vary significantly across countries and regulatory bodies. To ensure compliance and successful client outcomes, it’s essential to delve deeper into specific aspects like sales registration and tax implications, which can differ markedly between jurisdictions. Keeping yourself updated with the latest regulations in each country where your clients operate is crucial for maintaining compliance and providing accurate advice.

Challenges of investment suitability in a global landscape

Meeting investment suitability criteria in a global context can be a challenging task for financial professionals. Each country has its own set of regulations, making it intricate to navigate and ensuring compliance across borders. Requirements may vary from client information gathering to assessing the suitability of financial instruments based on local regulations.

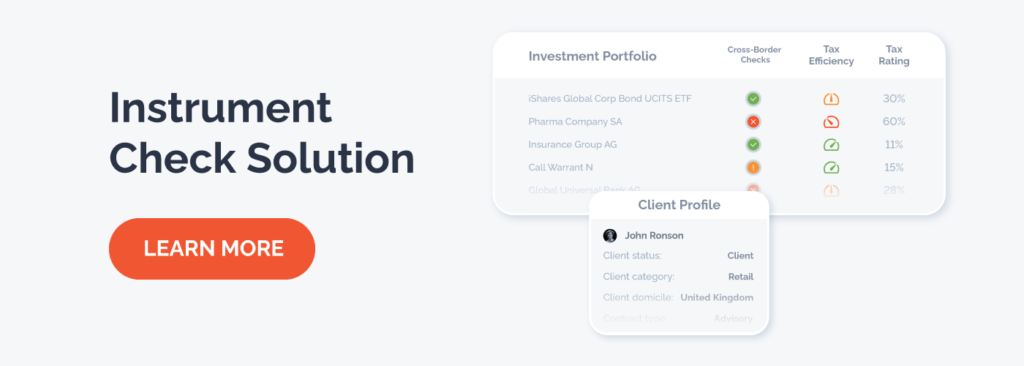

Simplifying investment suitability with Apiax’s solutions

To empower financial professionals like you with cutting-edge technology, Apiax offers comprehensive solutions designed to simplify the complexities of investment suitability, including instrument and service suitability checks. These advanced tools automate compliance validation processes, offering real-time updates on regulatory changes in multiple jurisdictions. By supporting suitability assessments, it ensures that your investment recommendations consistently meet global standards.