Apiax launches a new freely accessible tool designed to provide financial institutions with a broad overview of the regulatory burden associated with marketing financial services in any given jurisdiction.

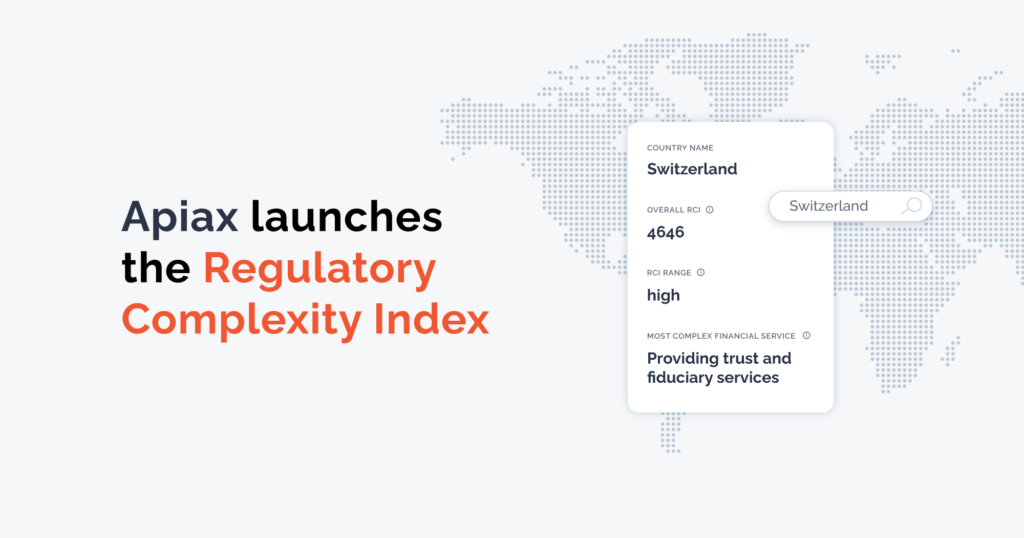

Apiax, a leading provider of embedded compliance solutions for the financial industry, today released the Regulatory Complexity Index (RCI). A data-backed calculator that leverages the Apiax rule repository which contains regulatory restrictions for 150+ jurisdictions and generates an absolute number that reflects a country’s regulatory environment for specific services.

Over the years, there has been a significant challenge to accurately measure regulatory complexity. At Apiax, we believe the complexity of regulation is not reflected in its text length or its frequency of updates, but in the complexity of restrictions it imposes on the business activities of regulated or unregulated entities in a specific jurisdiction.

According to our RCI, regulatory complexity refers to the number of regulatory restrictions a business faces when offering a specific financial service within a given country. It is the ever-changing landscape of rules and regulations that financial institutions must navigate, particularly for their cross-border operations.

In our view, regulatory complexity should be measured based on two crucial factors that directly impact the ease or difficulty of doing business:

- The country in question: Regulatory requirements vary greatly by jurisdiction.

- The service activity: It is important to understand the impact regulation has on a specific business activity in financial services.

Through this approach, a consistent framework for evaluating regulatory complexity is created, allowing for easy comparisons between regions, industries or services offered.

Philip Schoch, CEO at Apiax says: “We believe the RCI will be a valuable tool for financial institutions to gain a high-level overview of a country’s regulatory regime in no time”.

“Additionally, besides providing an overview of the complexity per country, the RCI can also be used to gain valuable insights into how specific banking services or investment products can be offered across multiple markets, making it an ideal tool for reviewing a financial institution’s go-to-market strategy”, adds Christina Frein, Chief Product Officer at Apiax. “However, the RCI does not release financial institutions from a detailed regulatory analysis, which is one of the services we provide to our clients.”

To explore how the Regulatory Complexity Index (RCI) works, visit apiax.com/rci

See full press release here.